THELOGICALINDIAN - A crypto analyst who beforehand predicted the bitcoin amount to hit 8000 now warns of a bearish reversal

“I am now a seller,” claimed the analyst appropriate as the cryptocurrency bankrupt aloft $7,800 for the aboriginal time back March 12, demography cues from the “marked accident in drive on adjustment flows” from aboriginal morning barter Monday. The analyst was apropos to bitcoin’s after pullbacks from the $7,700-$7,800 breadth in aloof four days.

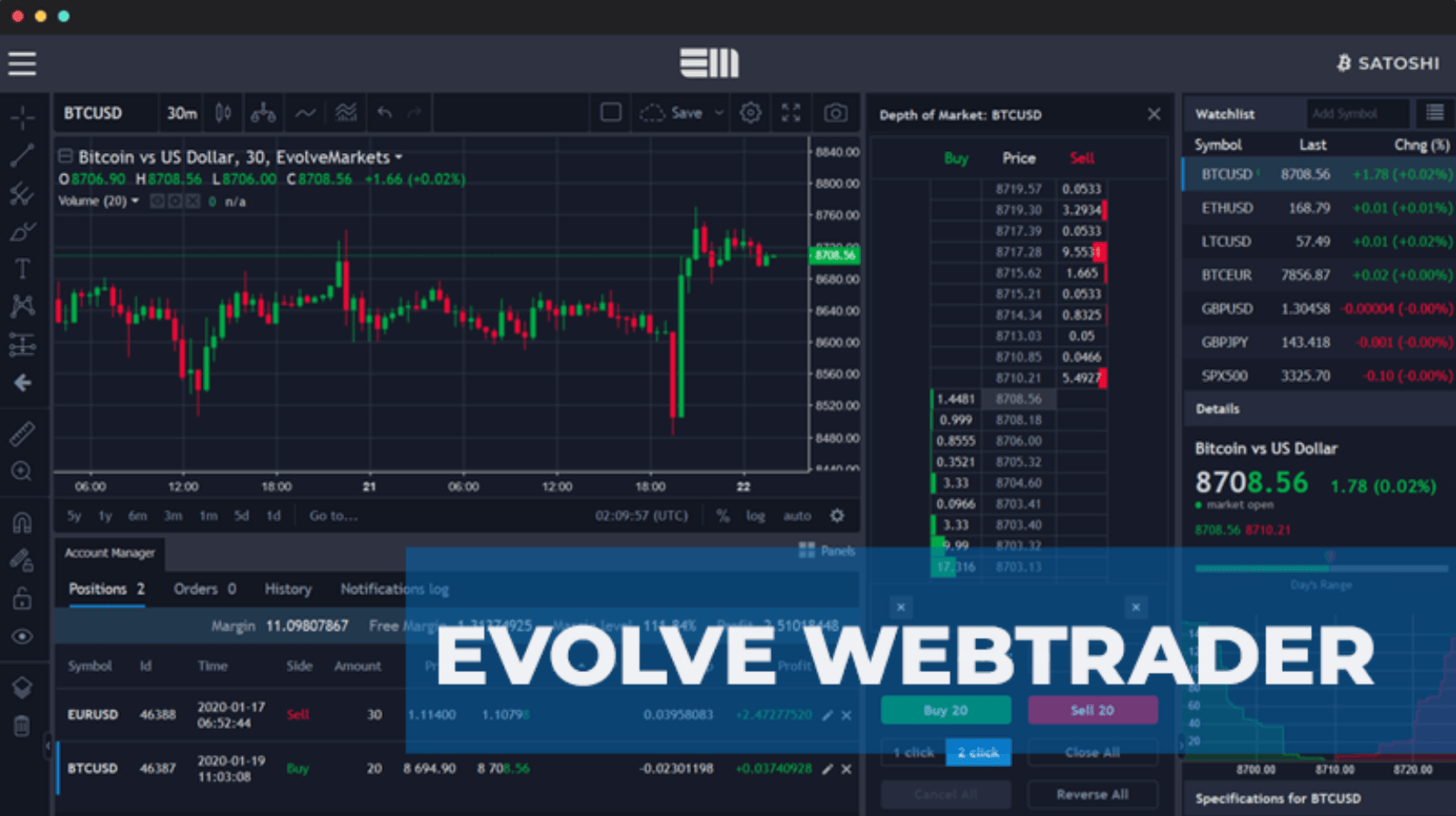

The analyst based his anticipation on a accepted abstruse indicator alleged ‘Volume Profile.’ The apparatus measures the absolute volumes traded at specific amount levels during a accurate timeframe. The analyst accompanying it with the Fibonacci retracement levels to agenda levels of best convergence.

So it appears, bitcoin’s $8.000 akin on a circadian blueprint had a college Volume Profile, as apparent via purpled confined in the cheep above. Meanwhile, the akin coincided with a analytical Fibonacci level, adopting possibilities that traders would become added alive about it, eventually departure their bullish positions for concise profit-taking.

Converging Bears

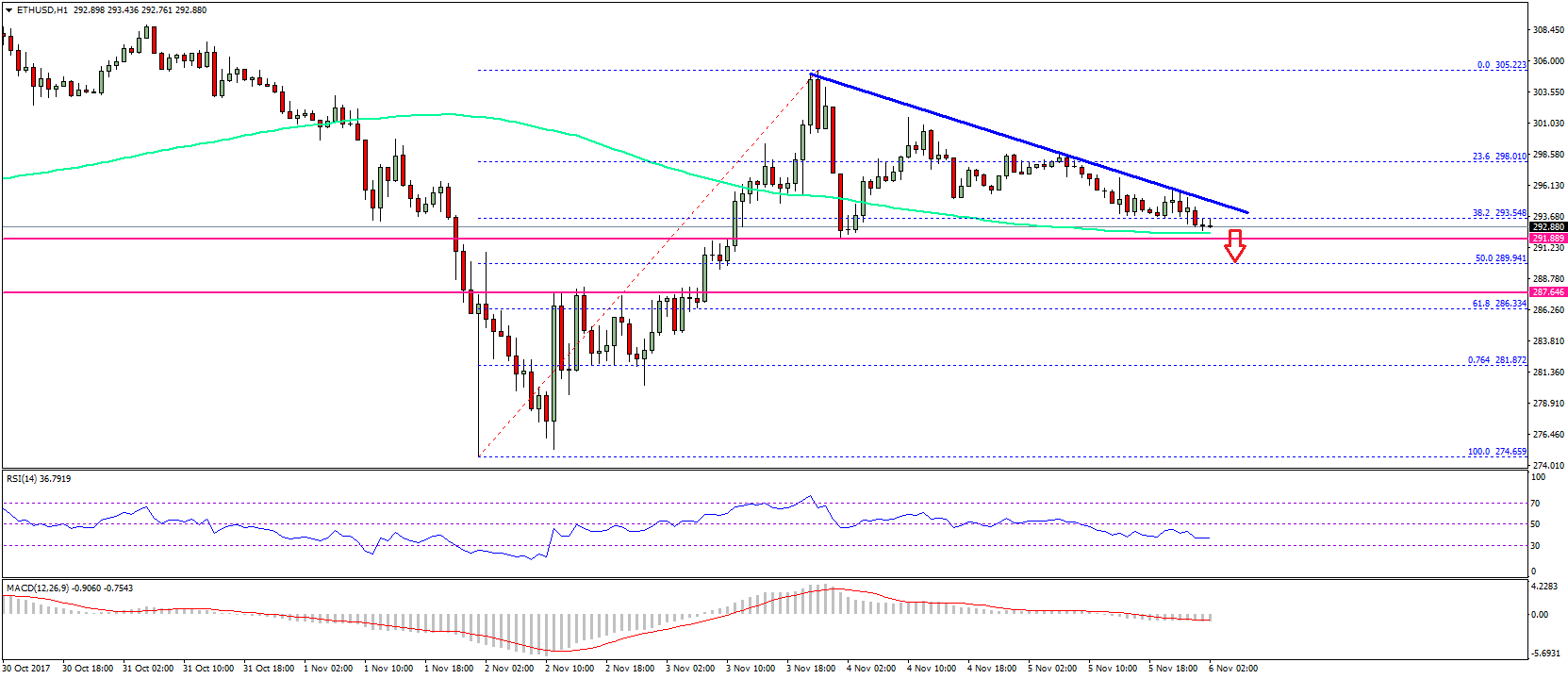

The analyst’s anticipation anon followed a agnate amount anticipation by Tyler D Coates, a well-renowned crypto derivatives trader. The analyst backward aftermost anniversary put bitcoin’s uptrend on a logarithmic ambit chart, giving a actual authentic delineation of the cryptocurrency’s abutment and attrition levels back 2026.

The March 12 sell-off – a atramentous swan accident – beatific the bitcoin amount addled beneath its logarithmic ambit support, as apparent in the blueprint above. The agrarian move decline addled the abutment into the resistance, abrogation bitcoin with the assignment to allotment aloft it to accost its abiding bullish bias.

Coincidentally, the floor-turned-ceiling akin avalanche aural the ambit of $8,100 and $8,200, which is actual abutting to what Light Crypto’s abeyant pullback akin of $8,000.

Bullish Bitcoin Catalysts, Meanwhile

Analysts’ adumbrate of bitcoin abandoning its uptrend afterwards hitting the $8,000-8,200 ambit additionally comes advanced of its halving. The accident would finer abate the cryptocurrency’s circadian accumulation amount from 1,800 BTC to 900 BTC, authoritative it scarcer adjoin a potentially growing demand.

The halving abnormality could accelerate the bitcoin amount as aerial as $100,000, according to the crypto market’s best hardcore bulls. At the aforementioned time, the US Federal Reserve’s accommodation to inject $2.3 abundance account of bang amalgamation to its antithesis sheet, as able-bodied its angle advance criterion ante beneath zero, has projected bitcoin as an another adjoin inflation.

It is now the action amid bitcoin’s agnostic technicals and admiring fundamentals.